Frequently asked questions centre

Your cover

Pet insurance helps cover the cost of vet care if your furry friend gets sick or injured. Whether they've had a little accident or come home with something unexpected, vet bills can add up fast. Our pet insurance is here to help ease that worry – covering things like accident, illnesses or if your pet goes missing.

We currently offer Lifetime cover, which is the most comprehensive type of pet insurance. It's designed to give you peace of mind year after year, with:

While there are other types of cover out there (like Accident Only or Time-Limited), we focus on Lifetime cover because it offers complete protection for your pet.

Absolutely! Arranging separate pet insurance for your pets can take lots of time and effort. Set tails wagging by insuring all your pets in one place. We've made it easy with discount of up to 10% on the premium for each pet and all your policies in one place, it's a treat all around.

We're here to help you care for your pet when it matters most. Our pet insurance typically includes cover for:

For full details - including what's covered, what's not, and any limits or exclusions - please check our policy wording.

You can take out a new policy for your cat or dog as soon as they are 8 weeks old. We insure cats until their tenth birthday and dogs until their eighth birthday. But don't worry, if you've already insured your pet with us before these milestones, cover can continue as they grow older.

We currently only cover cats and dogs. However, there are certain dog breeds that we can't insure and the full list can be seen here.

All insurance policies have restrictions. To find out more about our terms and conditions including exclusions, excesses, and limits, please take a look at our policy wording.

Yes. The Select & Protect Vet Assist provides 24/7 access year-round to qualified vet nurses and vets, available over the phone or via video. Using Select & Protect Vet Assist won't affect your premium and there is no excess to pay for this service either.

You can give them a call at 0333 332 3839.

If you want to change your level of cover, you will need to contact us.

Increasing your level of cover - You can increase your level of cover only at renewal.

Decreasing your level of cover - You can decrease your level of cover at any time.

You can make changes to your policy by contacting our team via Live Chat, email at petservice@select-protect.co.uk, or phone on 0333 034 8945.

Yes, the policy does include some exclusions, such as:

For the full list of exclusions, please check our policy wording.

Yes, you can - but if the surgery is for a pre-existing condition (or related to that condition) you won't be covered for the costs associated with it. Likewise, if the surgery is something that made the pet uninsurable, you may no longer be able to get cover.

Unfortunately, not. Routine care such as vaccinations, worming and other preventative treatments aren't covered under our policies. If you're ever in doubt, our policy wording outlines everything you need to know about your cover, including any cover limits.

If you are switching from another pet insurance provider and providing that there is no gap in cover, there will be no exclusion period for claims and your pet will be covered from your policy start date. For new policies, there's a 14-day exclusion period for illnesses and a 2-day exclusion period for accidental injuries from the policy start date.

A pre-existing condition means any health condition for which your pet has received treatment or medication in the 24-month period before the date of reoccurrence. We can cover conditions that haven't needed - or have been recommended to have - any treatment in the 24 months before this date, even if the condition started before your policy began.

If your vet recommends treatment for the condition during this time and you delay getting it, we won't cover that condition.

For more information about how we apply exclusions please read our policy wording.

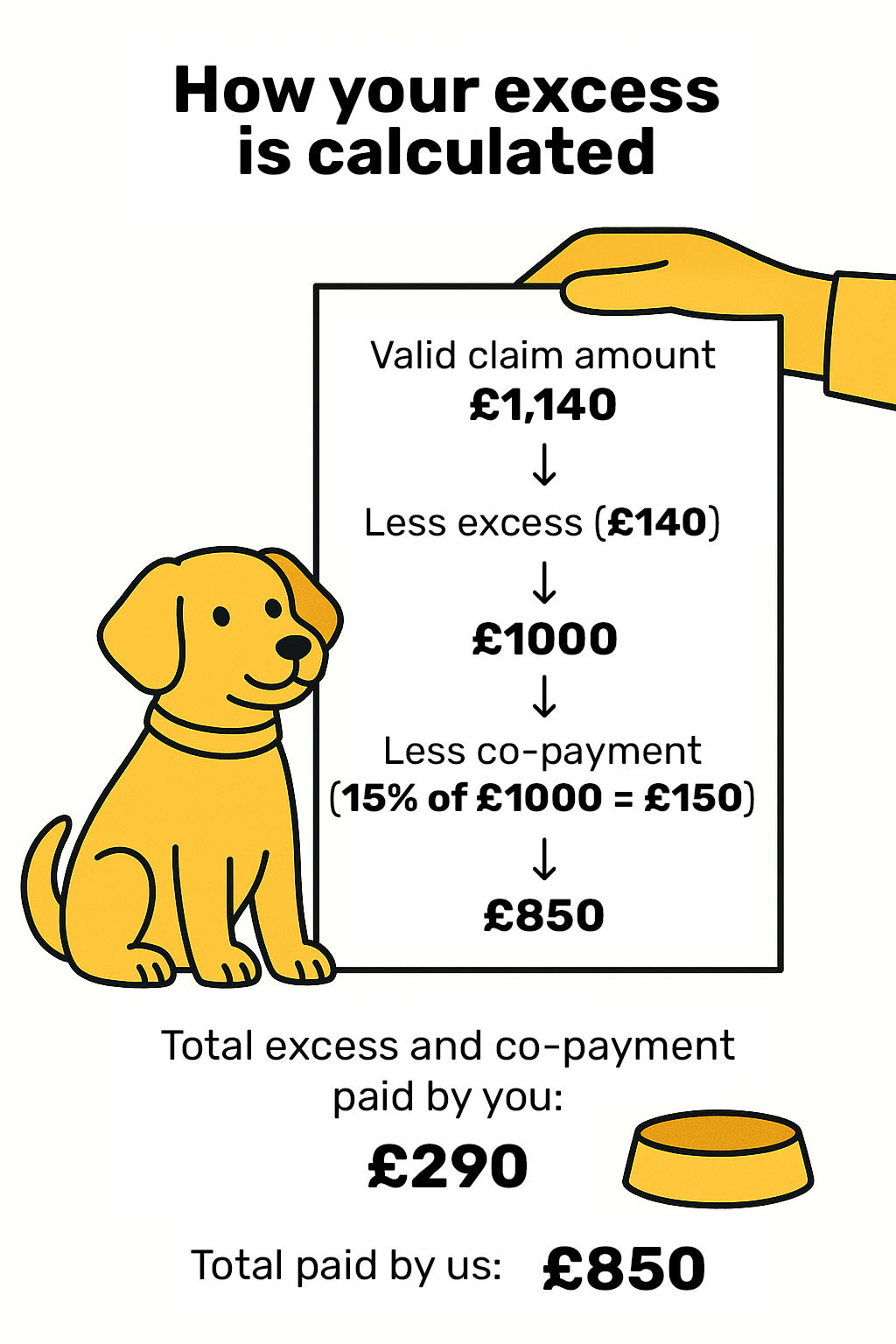

Yes - Just like people, as your pet ages the chances of them needing medical treatment increases, meaning you're more likely to claim on your policy. This means that your premiums may increase as your pet ages. To help us keep premiums as low as possible, when your dog turns 5 years of age, or your cat turns 7 years of age, a co-payment will apply to your policy from your next renewal date.

The co-payment is 15% and is paid by you each time you make a claim, in addition to your standard excess.

An example on how the excess is calculated is shown below:

Full details can be found in our policy wording or your policy schedule.

You're free to choose any vet you like — we'll never limit you to a specific practice. If you've not registered with a practice yet, visit the Royal College of Veterinary Surgeons database to find a vet near you.

If our service does not meet your expectations, we want to hear about it.

If you wish to make a complaint about the sale of your policy, please contact:

If you wish to make a complaint about how a claim was dealt with, please contact Davies:

Making a claim

Making a claim is easy! Just head to our website to fill out a claims form or give Davies , our Claims Administrator, a call on 0345 030 8116. If you need help, we'll guide you through the process to get everything sorted.

Additionally, you can make a vet fees claim online at https://SelectandProtectPet.davies-group.com.

That depends on your vet. Some are happy for us to pay them directly, while others may ask you to pay upfront and claim the cost back. Either way, keep all your receipts and documents handy. You can make a vet fees claim online at https://SelectandProtectPet.davies-group.com

Complete the online form, including details of your pet's condition, the vet's details and who we're paying treatment for.

Once your claim is submitted, the claims team will contact the treating vet for further details and process your claim. It would be helpful to let your vet know that they should receive an email from the claims team to complete their part of your claim.

Yes, your vet can submit a vet fee claim online at https://SelectandProtectVet.davies-group.com.

The excess is the amount you contribute towards a claim.

You can find your exact excess amount in your policy wording or by logging into your online portal.

Cancelling your policy

If you'd like to cancel, you can log into your online portal, get in touch with our team via Live Chat , email us at petservice@select-protect.co.uk or call us on 0333 034 8945 - we'll help you through it.

If you cancel within 14 days of the policy start date of your policy, or the date you received your policy documents, whichever is the later, you are entitled to a full refund providing you have not made, or intend to make, a claim. If we have paid a claim, then there will be no refund.

If you cancel after the first 14 days of the policy start date of your policy, or the date you received your policy documents, whichever is the later, we will cancel your policy and not collect the future monthly payments. If you have had a claim during this policy year, then we may deduct any outstanding monthly payments for the current period of insurance from your claim settlement.

Renewing your policy

We'll contact you before your policy is due to renew each year to confirm the price and any updated terms and conditions for the upcoming year. Please read all your policy documents carefully to ensure the cover still meets your needs and that your details, as well as your pet's, are accurate.

If you'd like to make any changes or cancel your policy, just let us know before the renewal date.

If you pay monthly by Direct Debit, your payments will continue using the bank details you've provided, and your policy will automatically renew unless you tell us otherwise.

Your premium may change due to a few factors such age of your pet, claims you've made, costs of vet's fees and re-evaluation of the risk. Prices are reviewed annually, and we will let you know your new price, including what you paid last year, as a reference.

Payment & billing

You can pay your policy by monthly instalments via Direct Debit - it does not cost any more to pay monthly. This can be set up during your purchase journey online or over the phone by calling 0333 034 8945, Monday to Friday, 9am to 5pm.

Unfortunately, we are unable to change the date of the direct debits.

Your first payment will be taken around 5 working days after your selected policy start date and your regular monthly payments will then be taken on this date each month.

Please call us on 0333 034 8945, and we can ensure that the payment is taken from the Direct Debit details saved on your policy.

We understand that this is a very difficult time financially for many but please be reassured that we are here to help.

You might be able to change your cover level to reduce the cost of your policy. You're able to decrease your cover at any point - we do not charge any fees for this. This can only be completed over the phone, so please call us on 0333 034 8945.

We want to make sure that you and your pet(s) continue to have the right cover so please don't struggle on alone, contact us to discuss the situation so we can help find the best option available for you.